- The boom in SPACs since the start of the pandemic is "becoming a mainstay of the capital markets," according to Dealogic.

- The hundreds of SPACs that are currently listed have more than $1 trillion in purchasing power.

- It took SPACs just a year to hit this level of purchasing power as opposed to decades for private equity.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The boom in SPACs since the start of the COVID-19 pandemic is showing no signs of slowing down, and is "becoming a mainstay of the capital markets," according to a report from Dealogic.

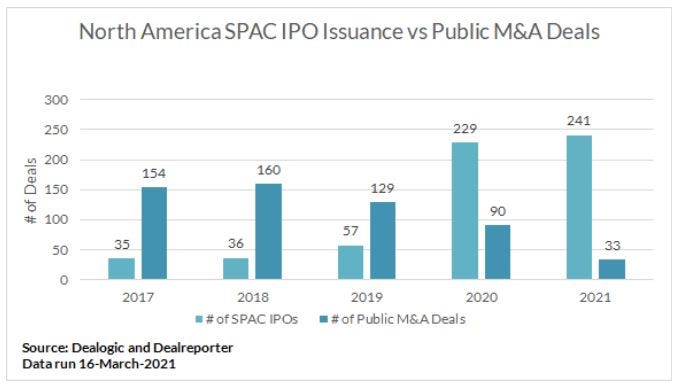

Since the beginning of 2020, there have been more than 500 SPACs that went public, as the traditional IPO route became more difficult amid a remote-work environment. In just the past week, 24 SPACs went public and more SPACs have already debuted so far in 2021 than in all of 2020.

Those hundreds of SPACs have upwards of $1 trillion in purchasing power, based on their current cash pile of $125 billion, the report said.

"Assuming that SPACs represent 10% to 15% of the pro-forma equity value of a target, this equates to about a trillion dollars of deal volume over the next one to two years," Dealogic said.

The meteoric rise of SPACs over the past year have resulted in an ascent in purchasing power that took private equity decades to achieve.

"When adjusting for the four to five years it takes for a PE fund to put money to work and the timing of capital calls, the purchasing power of SPACs and private equity are currently close to the same," Dealogic said.

The agility of SPACs offers benefits to both the investors and targeted company, meaning the SPAC boom likely has no end in sight.

"Investors have the right to redeem shares for cash if they do not wish to own the new company, essentially a built-in correction mechanism for shareholders to challenge deals...[and] while an IPO can take up to a year to execute, a SPAC transaction can be completed in a much shorter timeline," Dealogic explained.

One other factor boosting the prevalence of SPACs? Near-zero interest rates. Whether SPACs linger amid a rising interest rate environment will be a big test for the new going-public-investment-vehicle.